Diversifying your real estate portfolio in Goa beyond beachfront properties can offer numerous advantages, including potentially lower acquisition costs, different tenant demographics, and varied rental income streams.

Here are some strategies for diversifying your real estate investments in Goa:

- Historic Properties: Consider investing in historic homes or buildings in areas where there are Indo-Portuguese vintage houses. These properties often have unique architectural features and can appeal to tourists interested in cultural experiences.

- Urban Apartments: Explore investment opportunities in urban areas such as Vasco, Chicalim and Dabolim. Urban apartments can cater to a different demographic, including young professionals, students, and expatriates looking for convenient living options close to employment centers, schools, and amenities.

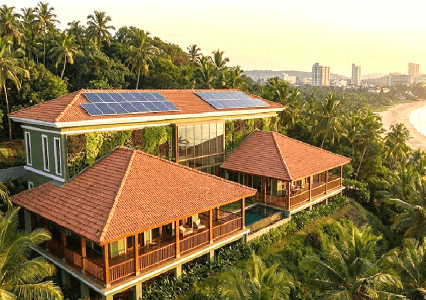

- We at Poetree Homes have come up with our flagship project 82 Ocean Crest at Dabolim, which is a buzzing urban suburb of South Goa that offers a lifestyle full of unlimited possibilities.

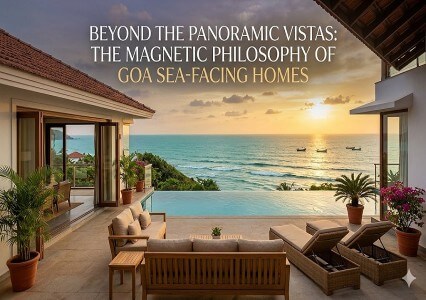

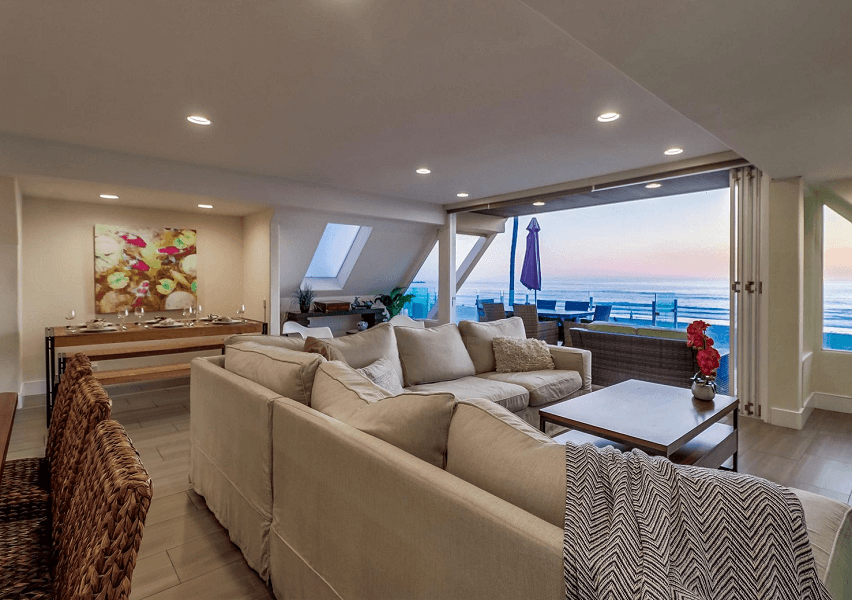

- Waterfront Properties: Properties along rivers, lakes, or backwaters can offer scenic views and recreational opportunities such as boating and fishing. Waterfront properties often have lower price points compared to beachfront locations but can still attract tourists and renters seeking waterfront living experiences.

- Our project 82 Ocean Crest at Dabolim provides a stunning vistas of the waterfront and the St. Jacinto Island which is the USP of the Project.

- Long-Term Rentals: Explore the long-term rental market by investing in residential properties suitable for local families or expatriates living in Goa. Long-term rentals can provide stable cash flow and minimize the seasonality often associated with vacation rentals

- 82 Ocean Crest is the flagship project of Poetree Homes and it is an excellent investment opportunity due to its potential for high rental income. Mesmerizing views of the waterfront and location are some of the USPs of 82 Ocean Crest that makes it a great investment opportunity.

- Rural Retreats: Look for properties in the hinterlands of Goa, away from the bustling coastal areas. Rural retreats offer tranquility and natural beauty, making them attractive to tourists seeking a peaceful getaway. You could invest in farmhouses, cottages, or eco-friendly retreats catering to wellness tourism.

- Commercial Spaces: Invest in commercial properties such as office spaces, retail outlets, or warehouses. With Goa's growing economy and increasing commercial activities, there's a demand for well-located commercial real estate. Focus on areas with thriving business districts or upcoming developments.

- Hospitality Ventures: Consider diversifying into hospitality by investing in boutique hotels, bed and breakfasts, or guesthouses. These properties can cater to both domestic and international tourists seeking unique accommodation experiences beyond traditional beach resorts.

- Mixed-Use Developments: Look for opportunities to invest in mixed-use developments that combine residential, commercial, and retail spaces. These projects offer diversification within a single investment and can provide stable rental income from various sources.

- Tourist Hotspots: Invest in properties near popular tourist attractions such as forts, waterfalls, or wildlife sanctuaries. These locations can attract visitors throughout the year, providing steady rental income and potential appreciation in property value.

- Real Estate Investment Trusts (REITs): Consider investing in REITs focused on the Indian real estate market, including properties in Goa. REITs offer diversification by pooling investments in a portfolio of properties managed by professionals, providing exposure to various real estate sectors without direct property ownership.

Conclusion: Before investing, conduct thorough market research, assess the potential risks and returns, and consider consulting with local real estate professionals or financial advisors familiar with the Goan market to make informed investment decisions. Additionally, ensure compliance with local regulations and legal requirements related to real estate investment in India.