Goa’s real estate market is a unique proposition and requires a nuanced understanding of its trends, dynamics, and insights to make informed investment decisions.

Here's a comprehensive guide to help investors navigate the Goa real estate market effectively:

- Market Overview: Goa's real estate market is characterized by a mix of residential, commercial, industrial and hospitality properties catering to both local residents and tourists. There are parameters such as overall market dynamics, supply and demand trends, pricing fluctuations and regulatory factors that shape up Goa’s real estate market.

- Tourism and Seasonality: Tourism plays a significant role in Goa's real estate market, with seasonal fluctuations impacting property demand and rental yields.

- The tourism industry in Goa is active on all 365 days of the year and during the peak tourist seasons such as winter and festive periods there is massive demand for rental properties since hotels are full to capacity during the season.

- Location Analysis: Goa is comprised of two districts, South Goa and North Goa. South Goa is calm and laidback in comparison to the buzzing nightlife of North Goa. All of Goa’s cities, villages, coastal areas, urban centers, and rural hinterlands have their own distinct identity.

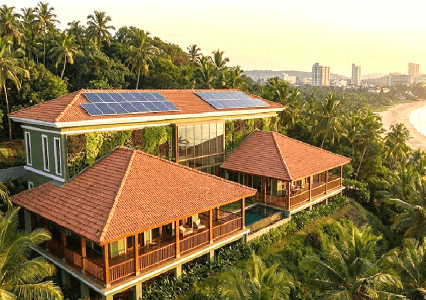

- Factors to be considered while looking for a property in Goa are proximity to beaches, infrastructure development, connectivity, and modern amenities.

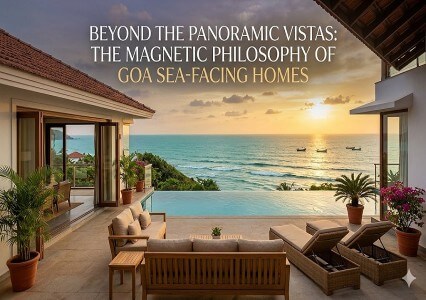

- We at Poetree Homes place a lot of weightage on location and choose one that boasts of commanding views of the waterfront and proximity to essential amenities.

- Property Types: Goa offers a diverse range of property types, including apartments, villas, independent houses, commercial spaces, and land. Each one of these property types comes with its unique characteristics and features.

- Investors should choose a specific property types that is in sync with their investment strategy. For instance, commercial spaces provide higher rentals than residential

- Infrastructure Development: Infrastructure projects, such as roadways, airports, ports, and urban utilities, influence the accessibility and desirability of real estate locations. Monitoring ongoing and planned infrastructure developments can provide insights into emerging investment opportunities and growth corridors.

- Local Economy and Employment: Goa's economy is driven by tourism, agriculture, manufacturing, and services sectors.

- A study of the local economic indicators, employment opportunities, income levels, and business prospects can help investors gauge the demand for residential and commercial properties in different market segments.

- For instance there is a growing demand for apartments in South Goa due to its significance as an industrial district whereas North Goa is popular for beachfront villas and luxury residences.

- Rental Market Analysis: Rental income is a significant parameter to consider for real estate investment. When an individual purchases a property for investment purpose, more often than not the idea is to put the property for rent.

- The buyers need to study and analyze the rental market dynamics, including vacancy rates, rental yields, tenant preferences, and lease terms, to achieve their desired investment goal. Understanding the rental demand drivers, such as tourism, expatriate population, and seasonal workforce, can inform investment decisions.

- Professional Advice: Consulting with local real estate experts, property developers, legal advisors, and financial planners can provide valuable insights and guidance tailored to the specific needs and objectives of investors navigating the Goa real estate market.We at Poetree Homes are a part of Essen Group and we have a total experience of 40+ years in the real estate industry. Thus we can provide expert advice on how to get maximum returns by investing in real estate.

Conclusion: By studying the market trends and seeking professional advice, investors can navigate the Goa real estate market effectively and capitalize on emerging opportunities for sustainable returns and portfolio growth.