Properties are divided into two segments: commercial and residential. However, whether to invest in residential or commercial properties depends on various factors, including your investment goals, budget, risk tolerance, and market conditions. Here is a comparison between the two types of investments.

Residential Properties:

- Rental Income: Residential properties in tourist destinations like Goa can fetch steady rental income, especially during the tourist season. Vacation rentals, serviced apartments, and long-term rentals are common in Goa.

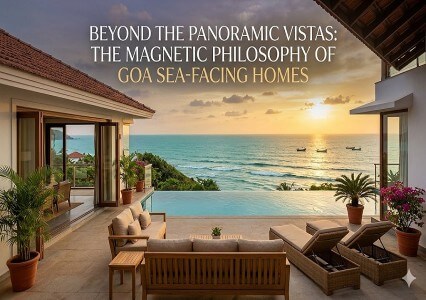

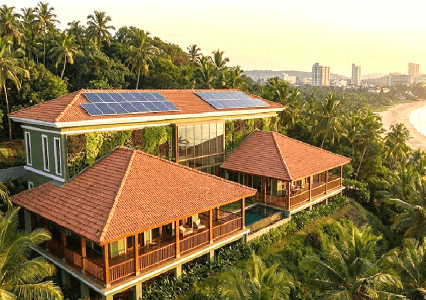

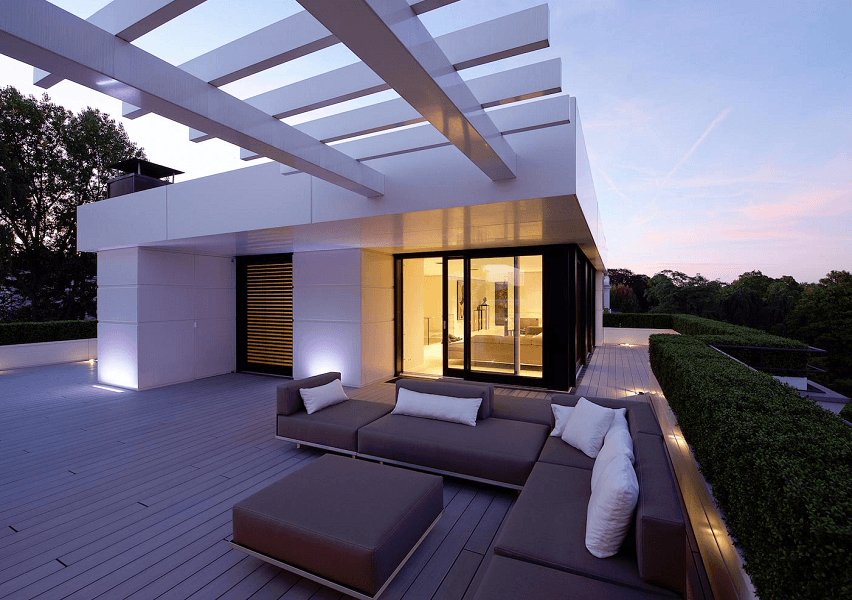

- Our Project 82 Ocean Crest located at Dabolim is a perfect option for real estate investment due to its, modern amenities resort-like ambience and mesmerizing views of the waterfront.

- Capital Appreciation: The value of residential properties in prime locations tends to appreciate over time, driven by factors like infrastructure development, tourism growth, and demand from both locals and tourists.

- Lower Initial Investment: Generally, residential properties require a lower initial investment compared to commercial properties, making them accessible to a broader range of investors.

- We at Poetree Homes provide flexible payment plans and our property prices are highly negotiable. This helps our clients in careful financial planning when purchasing their dream home.

- Seasonal Demand: Rental income from residential properties can be seasonal, with higher demand during the tourist season and lower demand during the off-season.

Commercial Properties:

- Rental Yields: Commercial properties, such as shops, restaurants, hotels, and office spaces, can yield competitive rental returns compared to residential properties, especially in prime tourist areas.

- Longer Lease Periods: Commercial leases typically have longer durations compared to residential leases, providing more stable and predictable income streams.

- Tourism Growth: With Goa being a tourist hotspot, investing in commercial properties catering to tourism, such as hotels, restaurants, and souvenir shops, can be particularly lucrative.

Factors to Consider:

- Location: The location plays a crucial role in determining the success of your investment. Consider factors like proximity to tourist attractions, infrastructure, accessibility, and zoning regulations.

- We at Poetree Homes believe that location is the most crucial factor when deciding to purchase one’s dream home. Hence our project 82 Ocean Crest is armed with panoraamic views of the riverfront and essential services are all located in close proximity of the project

- Market Trends: Analyze market trends, demand-supply dynamics, rental yields, and capital appreciation potential before making a decision.

- Diversification: Some investors prefer a balanced portfolio comprising both residential and commercial properties to spread risk and optimize returns.

- We at Poetree Homes reckon that it always pays rich dividend to invest in commercial and residential properties to get the desired leverage from real estate investments.

Conclusion: To conclude, it can be asserted that residential and commercial properties have their separate dedicated markets and it makes sense to invest in real estate based on futuristic visions.