Investing in real estate in Goa is a fast-growing trend that has developed in the last two decades (2000-2020) among property buyers. When an investor purchases a property, he also expects to get hefty returns on investments.

Analyzing the profitability in real estate investments requires careful consideration of various factors, including market trends, property characteristics, financing options, and potential returns.

Here's a step-by-step guide on how to analyze the profitability of real estate investments in Goa:

- Market Research: The most significant factor to be considered for real estate investments is market research. Understand the current real estate market trends in Goa, including property prices, rental yields, demand-supply dynamics and growth prospects.

- Factors such as tourism trends, infrastructure development, economic growth and government policies have a significant influence on the Goan real estate market.

- Property Selection: Selection of the property is crucial when it comes to investment in real estate. Investors need to select a property with competitive price and highest returns.

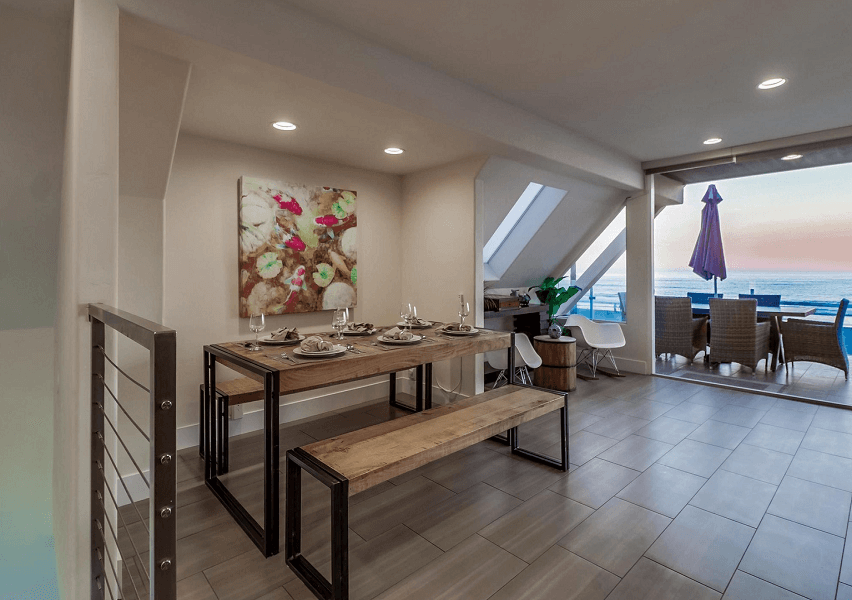

- Critical factors are location(sea-view), type (residential, commercial, vacation rental), size, condition(semi-furnished, fully-furnished) and amenities(with attached swimming pool, private elevators, etc)

- Factors like proximity to beaches, tourist attractions, employment hubs, transportation facilities, schools, hospitals, and shopping centers tend to yield higher rentals.

- Financial Analysis: Purchasing a property involves investing a huge lumpsum upfront and there are multiple charges and costs that make up the ultimate price of the property.

- Investors need to analyze the total investment required, including the property purchase price, transaction costs (stamp duty, registration fees), renovation or maintenance expenses, and financing costs (if applicable).

- Estimate potential rental income based on prevailing rental rates for similar properties in the area.

- Determine the expected annual expenses, including property taxes, maintenance fees, insurance, and vacancy allowance.

- Use financial metrics like cash-on-cash return, capitalization rate (cap rate), and internal rate of return (IRR) to evaluate the investment's profitability.

- Cash-Flow Projection: Prepare a cash flow projection to forecast the net cash flow generated by the investment over a specified period (usually 5-10 years).

- Consider factors such as rental income, operating expenses, financing costs, vacancy rates, and potential appreciation in property value.

- Analyze the sensitivity of cash flows to changes in key variables like rental income, expenses, and occupancy rates.

- Risk Assessment: Every investment comes with a risk. Thus investors need to access the risks associated with the investment, namely market risk, liquidity risk, tenant risk, regulatory risk, and macroeconomic factors.

- Assess the impact of potential risks on cash flow projections and overall investment returns.

- Implementation of risk mitigation strategies, such as diversification, insurance coverage and thorough due diligence can help in minimizing risks and maximizing returns.

- Exit Strategy: Develop an exit strategy based on your investment goals and market conditions.

- Consider options such as long-term rental income, short-term vacation rentals, property appreciation, resale, or redevelopment.

- Evaluate the tax implications and transaction costs associated with different exit strategies.

- Due Diligence:

- Before purchasing a property in Goa it always makes sense to comprehend the legal, structural, and environmental assessments.

- Review property documents, title deeds, land records, permits, and approvals to ensure clear and marketable title.

- Engage professionals like real estate agents, lawyers, surveyors, and property inspectors to assist in the due diligence process.

- Financing Options:

- Explore financing options such as bank loans, mortgage financing, or private financing to fund the investment.

- Evaluate loan terms, interest rates, loan-to-value (LTV) ratios, and repayment schedules to determine the most cost-effective financing option.

- Consultation and Expert Advice: Seek guidance from real estate professionals, financial advisors, and legal experts familiar with the Goan real estate market and regulations.

- Consult with local property management companies or real estate agents for insights into rental demand, property management, and tenant preferences.

Conclusion: Investors can earn handsome dividends by making informed decisions and maximize the profitability of their real estate investments in Goa.