Purchasing a property in Goa involves knowledge of various legal aspects governing land ownership, acquisition, transfer, and development in the state. Here is a list of property laws and regulations related to that need to be remembered by homebuyers.

- Land Tenure System: Goa follows a unique land tenure system known as the "Land Tenure Act" or "Code of Comunidades." Under this system, land is categorized into comunidade and private lands. Comunidade lands are traditionally owned and managed by comunidades (village communities) and are subject to specific regulations.

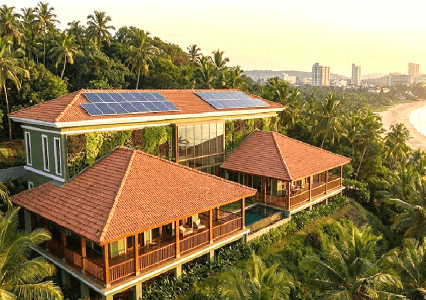

- We at Poetree Homes comply with all legal requirements with regards to purchase of land and obtain all necessary construction licenses from the relevant authorities to achieve transparency.

- Ownership Rights: Property ownership in Goa can be classified as freehold or leasehold. Freehold properties can be owned outright, while leasehold properties are held on a lease basis for a specified period.

- Conversion of Land Use: There is abundant land in Goa that is used for agricultural purposes. Any change in land use from agricultural to non-agricultural purposes requires permission from the appropriate authorities. The process involves obtaining a Conversion Sanad from the Deputy Collector.

- Title Verification: Before purchasing property in Goa, it's crucial to conduct a thorough title verification to ensure clear and marketable title deeds. This involves scrutinizing property documents, such as sale deeds, title deeds, encumbrance certificates and land records.

- Stamp Duty and Registration: Property transactions in Goa are subject to stamp duty and registration fees. These charges vary based on factors such as property value, location, and type of property. It's essential to pay the appropriate stamp duty and register the property to establish legal ownership.

- Development Regulations: Development projects in Goa must comply with local development regulations, including setback norms, floor area ratio (FAR), height restrictions and environmental guidelines.

- Environmental Clearances: Projects located in environmentally sensitive areas or involving significant land development require environmental clearances from relevant authorities to ensure compliance with environmental laws and regulations.

- Inheritance Laws: In cases of property inheritance, succession laws apply, and the inheritance process is governed by personal laws based on religion, such as the Hindu Succession Act, 1956, and the Indian Succession Act, 1925.

- Dispute Resolution: Property disputes in Goa are adjudicated through civil courts. It's advisable to seek legal counsel and explore alternative dispute resolution mechanisms like mediation or arbitration to resolve conflicts efficiently.

- Foreign Ownership: Foreign nationals are subject to specific regulations and restrictions when purchasing property in Goa. It's essential to understand the Foreign Exchange Management Act (FEMA) guidelines and obtain necessary approvals from the Reserve Bank of India (RBI) for property transactions.

- Real Estate Regulatory Authority (RERA): The concept of RERA has been introduced in Goa to regulate the real estate sector, protect the interests of buyers and ensure transparency and accountability in real estate transactions.

- Taxation: Property owners in Goa are liable to pay Goods and Services Tax (GST) to the local municipal corporation or village panchayat. Additionally, income from property, such as rental income or capital gains from property transactions, is subject to income tax as per the Income Tax Act.

Conclusion: For a thorough understanding of property laws in Goa, it is advisable to conduct online research and to consult with legal experts or real estate professionals specializing in Goan property laws.